Paypal To Introduce Credit Card With 2% Cash Back

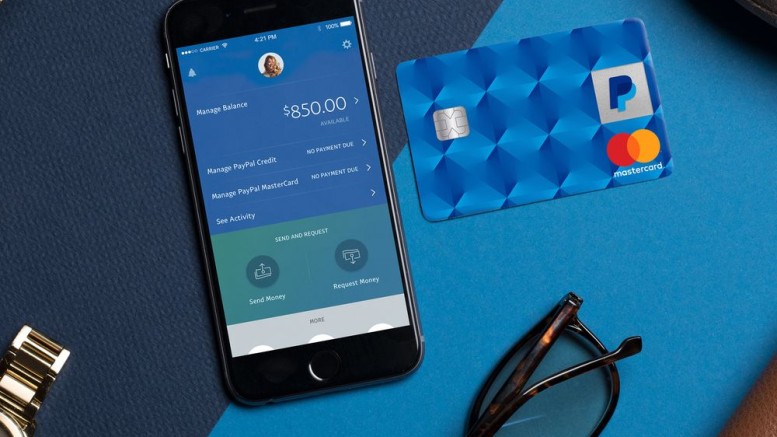

PayPal Holdings Inc. is planning to relaunch its old product to extend services beyond the digital realm.

The online payment giant is introducing a credit card that will offer customers 2 percent cash back on purchases, one of the few highest rebate rates, with no annual fee.

In an effort to transform PayPal into a financial tool for everyday use by its 210 million customers. Dan Schulman, the Chief Executive Officer of PayPal, has forged 24 deals in the last 18 months with financial and technology companies including Apple Inc., Visa Inc. and JPMorgan Chase & Co.,

“Not only are they using us to shop outside of PayPal in the physical world but they’re also shopping more on PayPal with this card,” said Darrell Esch, chief commercial officer for global credit at the San Jose, California-based company.

In the last 12 months, transactions per user has risen 10 percent to 32.3, according to a company statement.

However, with Nigerian mobile shoppers spending $610 million in 2015 through the online payment company and an estimated $812 million in 2016. “Access to a globally acceptable credit card and 2 percent rebate might see that number a little above a billion dollar soon,” said Samed Olukoya, a foreign exchange research analyst at Investors King Ltd.

“This could lead to more capital flight and worsen financial woes of local e-Commerce companies,” he added.

It is unclear if PayPal would allow Nigerian users access to its new product or extend withdrawal restriction to the credit card in Nigeria.

Nigeria is currently ranked third largest mobile shopper by PayPal Holdings Inc.

The online payment giant has partnered Synchrony Financial, the biggest issuer of private-label credit cards, to help rollout the cards.

The online payment giant is introducing a credit card that will offer customers 2 percent cash back on purchases, one of the few highest rebate rates, with no annual fee.

In an effort to transform PayPal into a financial tool for everyday use by its 210 million customers. Dan Schulman, the Chief Executive Officer of PayPal, has forged 24 deals in the last 18 months with financial and technology companies including Apple Inc., Visa Inc. and JPMorgan Chase & Co.,

“Not only are they using us to shop outside of PayPal in the physical world but they’re also shopping more on PayPal with this card,” said Darrell Esch, chief commercial officer for global credit at the San Jose, California-based company.

In the last 12 months, transactions per user has risen 10 percent to 32.3, according to a company statement.

However, with Nigerian mobile shoppers spending $610 million in 2015 through the online payment company and an estimated $812 million in 2016. “Access to a globally acceptable credit card and 2 percent rebate might see that number a little above a billion dollar soon,” said Samed Olukoya, a foreign exchange research analyst at Investors King Ltd.

“This could lead to more capital flight and worsen financial woes of local e-Commerce companies,” he added.

It is unclear if PayPal would allow Nigerian users access to its new product or extend withdrawal restriction to the credit card in Nigeria.

Nigeria is currently ranked third largest mobile shopper by PayPal Holdings Inc.

The online payment giant has partnered Synchrony Financial, the biggest issuer of private-label credit cards, to help rollout the cards.

Comments

Post a Comment